Affiliates can target hundreds of different countries, but these nations can be placed into groups because they share similar languages, currencies, or traditions. Many affiliates are familiar with major geographical regions such as North America, Europe-Middle East-Africa (EMEA), and Asia-Pacific (APAC).

However, Latin America (LATAM) is perhaps the up-and-coming region that shows the most promise, thanks to a solid combination of relatively low competition and sky-high potential, especially when working with advertisers in the financial vertical.

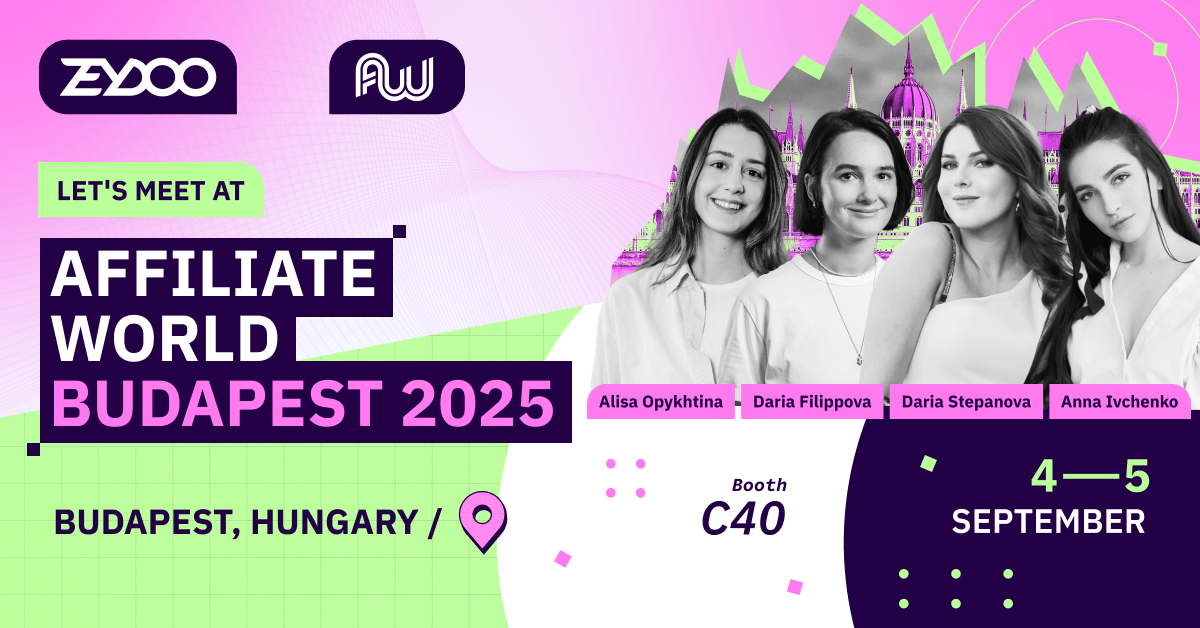

At Zeydoo, we work with some of the top LATAM advertisers and affiliates in the finance industry, so we’ve kept a close eye on the evolution of the vertical.

In this article, we’ll go over the finance vertical in LATAM, the elements that have fueled the growth of this industry, and discuss the best types of traffic for this type of campaign.

Note that all the numbers and statistics we’ll share have been gathered through by our Head of Marketing, Uliana Moreva, thorough research of our holdings as well as data provided by our clients and partners in the region.

Table of contents

The Finance Vertical in LATAM By the Numbers

The finance vertical has experienced accelerated growth since the year 2019 in Latin America. According to our research, the finance niche is now 72% bigger than it was back in 2019, plus the number of CPA programs available have increased by a stunning 54%.

At the same time, traffic has been growing more and more, not to mention the fact that a huge influx of new advertisers have come into the market in the last 21 months.

What Has Fueled the Growth of This Industry?

It’s important to understand that, like other industries, the finance niche experienced exponential growth because the current environment has allowed it to flourish as such. That said, there are two single variables that have heavily influenced the increased traffic as well as advertisers in the industry.

These are:

COVID-19

The global health crisis officially kicked off in 2020, although the first cases were reported at the end of 2019. Nevertheless, the COVID-19 pandemic has shaken the world’s economic landscape and forced financial institutions to get creative with everything from their structure to the services they offer.

The result has been refreshing as these institutions have turned to previously sidelined consumer segments. Which, in turn, has contributed heavily to the rise in new services and companies, as well as the overall growth of the niche.

Real Devaluation in Brazil

The LATAM region is composed of a huge number of countries, but Brazil is by far the biggest economy with a GDP of almost 1500 billion US dollars.

However, the real, Brazil’s currency, has been devaluating steadily since early 2019, which has forced financial institutions to explore other markets in the region — which has led to great success.

The Rise of Niche Banking

We mentioned the fact that financial institutions were now starting to tap into previously sidelined segments and niche banking institutions are a direct result of this process.

For instance, Z1 is a banking app in Brazil that’s designed specifically for generation Z consumers because they focus on providing teenagers with their first bank account. Mono is a banking solution that’s designed to help small and medium-sized businesses (SMBs), to the point of providing services over common messaging apps like WhatsApp.

Moreover, Pride bank in Brazil is the very first financial institution in LATAM that offers services designed for the LGBTQ+ community.

Lana is another great example as this app is designed to be a one-in-all solution for consumers in LATAM that are part of the gig economy. And, there’s always Lidh in Mexico, a bank designed to provide financial services to women.

Tougher Competition

Digital financial institutions finally started gaining significant territory in LATAM in 2020, after being limited to Chile, Brazil, Mexico, and a few other countries. However, conventional banks face a huge amount of competition today because financial institutions that are ran digitally often provide better conditions.

The result has been great for consumers and affiliates as both types of financial institutions are now offering better deals and affiliate programs to reel in more customers.

What Type of Traffic Is Best for the LATAM Finance Vertical?

In terms of performance, volume, and profitability, social media traffic tends to provide the best results for LATAM financial campaigns. The problem is that most banks manage their social efforts separately, so they don’t tend to allow this type of traffic.

Instead, you should opt for push ads and native notifications, both of which deliver great conversion rates. At the same time, banners and email marketing have been proven to provide great results when combined with certain offers, like microloans.

Conversion Flow Types

As for conversion flows, the most common types are CPL, CPI, COA<, and SOI/DOI. The best alternative in terms of performance is CPL, but it’s worth experimenting with CPA conversions to see how your audience reacts to this type of offer.

Top offers for LATAM

Ready to launch a finance campaign in LATAM? Find the best offers and work with the leading affiliates by partnering with Zeydoo.

Cartão Carrefour – MX

Flow: CPL

Payout: $3,034

Banco Santander – BR

Flow: CPL

Payout: $9,35

Orama Investment – BR

Flow: CPL

Payout: $6,72

Guide Investment – BR

Flow: CPL

Payout: $6.72

Safra Credito Consignado – BR

Flow: CPL

Payout: $4.4

Banco Bradesco – BR

Flow: CPL

Payout: $2

Rapicredit – CO

Flow: CPI

Payout: $0,238